Property DC Valuation in Pakistan – Latest DC Rates Punjab & Major Cities 2025

-

Written by:

Icons Team

Icons Team - Last updated: February 14, 2026

- Valuation

If you’ve ever wondered how the government sets official property values in Pakistan, you’ve come to the right place. DC (District Collector) Valuation determines the minimum legal price of any property.

Whether you’re buying, selling, or transferring a plot, house, or commercial property, DC rates decide how much you’ll pay in stamp duty, capital value tax (CVT), and transfer fees. Understanding DC valuation helps you plan property transactions without surprises, compare market vs official values, and stay compliant with the law.

By understanding DC valuation, you can:

- Avoid overpaying taxes or fees during property transfers.

- Compare official DC rates with market values to make smart decisions.

- Plan your investment in residential or commercial properties confidently.

Discover how property taxes affect your investment, explore property taxation in Pakistan, and make informed decisions today.

In this comprehensive guide, you’ll learn:

- What Property DC Valuation is and why it matters.

- How DC valuation affects taxes, stamp duty, and fees.

- How to check DC values online and offline for Punjab

- How Punjab’s e-Stamp system calculates fees using DC rates.

- Differences between DC rates and FBR property valuation rates.

- Determine the DC value for any property type (Step-by-Step).

Let’s explore DC valuation in Pakistan in a way that helps you make informed, hassle-free property decisions.

What Is Property DC Valuation?

DC valuation is the official property value set by the government for:

- Stamp duty

- Capital value tax (CVT)

- Registration fees

- Mutation charges

Key points:

- It is lower than market value, making it a legal benchmark.

- Every district maintains its own DC rate list, updated by the revenue department.

- You need it whenever you buy, sell, transfer, or register property.

Example:

A 5-Marla plot in Lahore may have a DC valuation of PKR 1,200,000, but the market price could be PKR 7,000,000. Stamp duty and mutation charges are based on the DC value, not market value.

DC valuation ensures fairness, transparency, and legal compliance in property transactions.

- Discover the Latest Osaka Battery Prices in Pakistan Today. Click here to stay up to date on battery prices and make informed decisions.

- Find Out Marble Prices in Pakistan Today. Explore updated marble prices to plan your construction needs effectively.

- Check Today’s Cement Rate in Pakistan. Discover the current cement rates to budget your projects effectively.

The Meaning of the DC Rate

The DC rate (District Collector Rate) is the minimum official property value set by the provincial government. It is used to calculate:

- Stamp Duty

- Capital Value Tax (CVT)

- Registration Fees

- Mutation Charges

Banks, courts, and DC offices rely on DC rates as the official benchmark. Without it, property transfers cannot proceed.

Example:

If you are transferring a plot, the DC office will calculate fees based on the DC rate. This ensures your transaction is legally compliant and completed without delays.

Why DC Valuation Matters for Every Property Owner

The DC rate keeps property transactions fair and accountable. Even if the market price is higher, the government uses DC values to calculate all fees.

- Ensures property deals are legally compliant

- Prevents disputes between buyers and sellers

- Helps plan taxes and transfer costs

Think of it this way: the DC rate defines the minimum sale price on paper. Even if you sell a property for less, the government will still calculate your taxes based on this minimum threshold.

Now, many people ask:

Can I adjust the DC rate or lower it for my property taxes?

The answer is simple: no. You cannot reduce the DC rate because the government sets it. It’s the lowest official limit you must follow.

However, you can pay taxes on a higher value, up to the property’s fair market price, if the sale amount exceeds the DC rate.

Bottom line: Understanding DC valuation helps you plan your property deals, budget for taxes, and avoid surprises at the registrar’s office.

See Also: Here are the ICONS HowTo guides, such as FRC Nadra Online Apply, for a hassle-free and fast experience.

How to Get the Latest DC Rate – Punjab & Major Cities 2025

You can check updated DC rates using:

- Official Punjab DC Rate Calculator

- Covers Lahore, Rawalpindi, Faisalabad, Multan, and other districts

- Provincial Government Websites

- DC rates are updated annually

- Local DC Offices

- Obtain verified tables and expert guidance

Step-by-Step Guide to Determine DC Value

- Visit the Official Calculator – Enter city, Tehsil, property type, plot size, and revenue circle.

- Check Your Result – DC rate is calculated per Marla or Kanal, for residential and commercial plots.

- Compare with Market Value – Plan stamp duty, CVT, and mutation charges accurately.

Factors affecting DC value:

- Location, city, and Tehsil

- Property type (residential, commercial, agricultural)

- Plot size and floor

- Revenue circle and land category

This works for DHA, Bahria Town, and other housing schemes across Punjab and Islamabad.

This method works for DHA, Bahria Town, and other housing schemes across Punjab and Islamabad.

Because DC valuation affects stamp duty, capital value tax, mutation charges, and transfer fees, knowing the correct value saves you from surprises at the registrar’s office.

Here is the step-by-step online process to determine the DC Value of any property across Pakistan. Get accurate and up-to-date information in just a few clicks!

1

Step 1: Use the Official Calculator

Step 1: Visit the official DC rate calculator. Here is the link to view the rates for raw land, plots, houses, and flats in the Punjab area.

2

Step 2: Enter Details

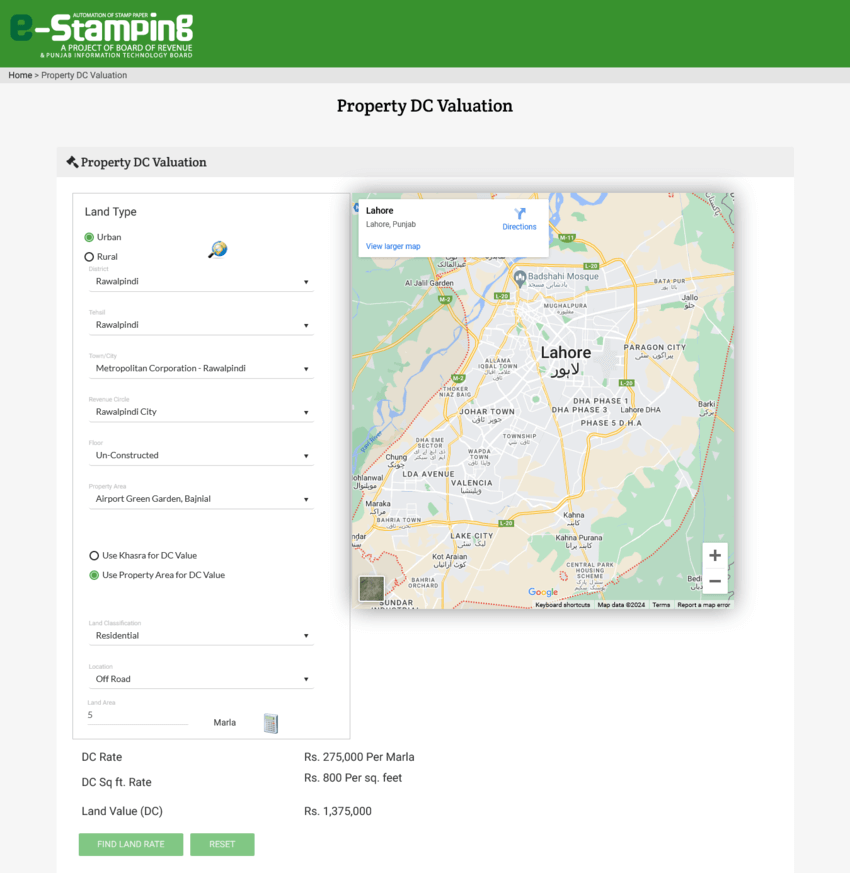

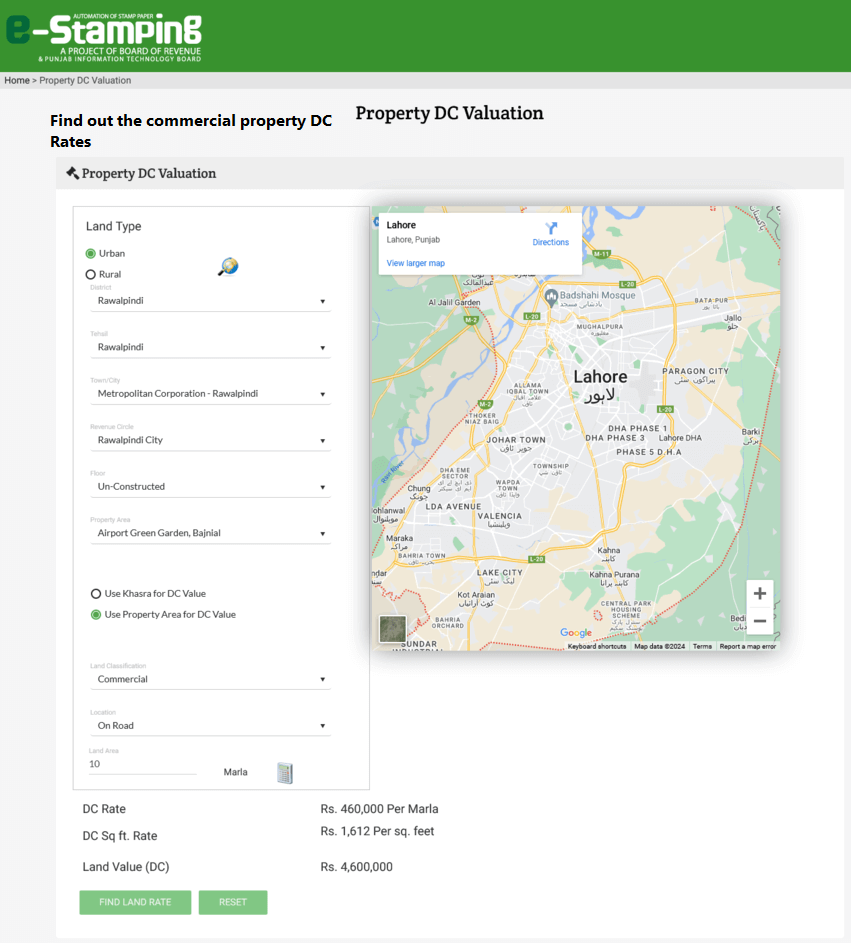

In step 2, you must fill out the required details, such as whether you own property in an urban or rural area.

With that, select the District, Tehsil, Town City, Revenue Circle, floor, property area, and land classification.

To show you what I mean:

Here is how you can determine the DC value of a residential plot in the Airport Green Garden housing project in Rawalpindi, Punjab. You need to fill out the form as you see in the image below:

3

Step 3: Get Your Value

Finally, press the “Find Value” button to obtain the DC value of an area. You will then get the value of your desired location or Mouza. The found value would be, per Marla, whether residential or commercial.

For instance, to get a 5-Marla plot DC value, multiply the found value of 1-Marla by 5.

The following factors determine the property DC value:

- Location

- Tehsil

- District

- City or town

- Revenue circle

- Floor

- Property type

Here is the best part. You can determine the DC rates for any scheme using the step-by-step process outlined above, including those for the Defence Housing Authority (DHA) in Rawalpindi, Bahria Town in Rawalpindi, Karachi, and other similar schemes.

See Also: For in-depth area guides on housing schemes and societies, refer to the ICONS Area Guides, which include information on obtaining FRC Nadra hassle-free and quickly.

City-Wise DC Rate Tables – Punjab & Islamabad 2025

DHA Lahore – Residential & Commercial Rates

| Phase | Residential DC Rate (per Kanal) | Commercial DC Rate (per Marla) |

|---|---|---|

| Phase 1 | ₨ 20,000,000 | ₨ 4,000,000 |

| Phase 2 | ₨ 20,000,000 | ₨ 4,000,000 |

| Phase 3 | ₨ 24,000,000 | ₨ 3,800,000 |

| Phase 4 | ₨ 17,000,000 | ₨ 4,600,000 |

| Phase 5 | ₨ 22,000,000 | ₨ 3,700,000 |

| Phase 6 | ₨ 15,000,000 | ₨ 3,100,000 |

| Phase 7 | ₨ 9,000,000 | ₨ 2,300,000 |

| Phase 8 | ₨ 11,000,000 | ₨ 2,000,000 |

| Phase 9 | ₨ 6,000,000 | ₨ 835,000 |

| Phase 10 | ₨ 3,000,000 | ₨ 640,000 |

Note: Rates vary; always verify with DC offices or online portals before completing a transaction.

Rawalpindi – Residential & Commercial Rates

| Area | Residential DC Rate (per Kanal) | Commercial DC Rate (per Marla) |

|---|---|---|

| DHA Phase 1 | ₨ 1,500,000 | ₨ 4,400,000 |

| DHA Phase 2 | ₨ 1,400,000 | ₨ 5,000,000 |

| DHA Phase 3 | ₨ 600,000 | ₨ 1,300,000 |

| DHA Phase 4 | ₨ 400,000 | ₨ 1,300,000 |

| DHA Phase 5 | ₨ 800,000 | ₨ 1,300,000 |

| DHA Valley | ₨ 250,000 | ₨ 575,000 |

Track market trends effortlessly and view the latest silver rate in Pakistan today.

How Punjab’s e-Stamp System Uses DC Rates

- Calculates stamp duty online based on DC valuation

- Replaces paper stamps with secure digital stamps

- Each e-Stamp has a QR code and a unique ID

- Required for sale deeds, transfer deeds, gift deeds, and property registrations

Example: If your plot’s DC value is ₨ 2,000,000, e-Stamp calculates the exact stamp duty. Pay online, download your official e-Stamp, and submit to the registrar. With e-Stamp, the government ensures accuracy, speed, and security in property transactions.

Punjab’s e-stamp system also relies on the latest DC rates to calculate property taxes. This system is updated regularly, and you can get the current rates through the e-stamp portal. For the most current DC rates in Punjab, follow these steps:

Looking for more helpful tips? Check out our ICONS How-to Guides for easy-to-follow solutions to common problems. Learn how to master new skills today!

Latest FBR Property Valuation Rates

The table below has the DHA Rawalpindi Property Valuation residential and commercial rates:

| Area | Residential DC Rate (Per Kanal) (PKR) | Commercial DC Rate (Per Marla) – PKR |

| Phase 1 | 1,500,000 | 4,400,000 |

| Phase 2 | 1,400,000 | 5,000,000 |

| Phase 2 (Extension) | 400,000 | 1,300,000 |

| Phase 3 | 600,000 | 1,300,000 |

| Phase 4 | 400,000 | 1,300,000 |

| Phase 5 | 800,000 | 1,300,000 |

| DHA Valley | 250,000 | 575,000 |

Need to send mail or verify an address in Lahore? Find the right area code fast with this Lahore postal codes guide.

DC Rate vs FBR Property Valuation Rate

Provincial governments use DC rates for local taxes. The FBR uses its rates for federal property taxes.

DHA Lahore Example – Residential DC vs FBR Rate

| Phase | DC Rate per Kanal | FBR Rate per Kanal |

|---|---|---|

| 1 | ₨ 20,000,000 | ₨ 27,000,000 |

| 2 | ₨ 20,000,000 | ₨ 27,000,000 |

| 3 | ₨ 24,000,000 | ₨ 27,000,000 |

| 4 | ₨ 17,000,000 | ₨ 30,000,000 |

| 5 | ₨ 22,000,000 | ₨ 30,000,000 |

Knowing the difference helps plan property transfer costs and taxes accurately.

FBR Rates vs DC Valuation in DHA Rawalpindi

I get this question frequently.

What is the difference between DC Rates and FBR Rates?

The simple answer is that provincial governments calculate tax liabilities using the DC rate, while the federal government uses FBR valuation rates for taxes under its jurisdiction.

The table below highlights the differences between FBR and DC rates. These rates are for different phases of DHA Lahore:

| DHA Phases | Residential DC Rate (per Kanal) | Residential FBR Rate (per Kanal) |

| Phase 1 | ₨ 20,000,000 | ₨ 27,000,000 |

| Phase 2 | ₨ 20,000,000 | ₨ 27,000,000 |

| Phase 3 | ₨ 24,000,000 | ₨ 27,000,000 |

| Phase 4 | ₨ 17,000,000 | ₨ 30,000,000 |

| Phase 5 | ₨ 22,000,000 | ₨ 30,000,000 |

| Phase 6 | ₨ 15,000,000 | ₨ 32,000,000 |

| Phase 7 | ₨ 9,000,000 | ₨ 35,000,000 |

| Phase 8 | ₨ 11,500,000 | ₨ 28,000,000 |

| Phase 9 | ₨ 6,000,000 | ₨ 23,000,000 |

| Phase 10 | ₨ 3,000,000 | ₨ 27,000,000 |

Looking for detailed information on different neighbourhoods? Visit our ICONS Area Guides for in-depth insights into amenities, lifestyle, and investment potential across various locations.

Key Takeaways:

- FBR rates are generally higher than DC rates

- Phase 7 has the most significant disparity between FBR and DC rates

- Phase 10 has the lowest FBR rate among all phases

You are to understand the difference between FBR and DC property valuation rates. It can help you make informed decisions when buying or selling properties. Stay ahead of the game with this valuable insight!

Real estate transactions are subject to four types of taxes: the provincial government collects “stamp duty” and “capital value tax.”

The federal government collects “capital gain tax” and “withholding or advance tax”.

Provincial governments calculate tax liabilities using the DC rate, and the federal government uses FBR Property valuation 2025 within its jurisdiction.

Key Takeaways for Property Owners

- DC rates are mandatory for all property transactions

- FBR rates are generally higher than DC rates

- e-Stamp links DC rates with digital verification, preventing fraud

- Step-by-step calculation ensures no surprises during registration

FBR Property Valuation of Major Cities in Pakistan

The Federal Board of Revenue (FBR) started property valuations in urban centres in 2018. Since then, they have raised the valuation three times: in 2018, 2019, and, most recently, in December 2021.

Unlock Your Dream Home Today: Discover the best housing schemes in Islamabad that offer comfort, luxury, and modern living. Click here to discover the top options and begin your journey toward the ideal lifestyle.

Access FBR Property Rates in Major Pakistani Cities

You can explore and download the latest FBR rates for commercial and residential properties in key cities across Pakistan by clicking the links below:

- Find Rawalpindi Property Rates

- Check Islamabad Property Rates

- Explore Lahore Property Rates

- View Karachi Property Rates

- Discover Peshawar Property Rates

- Browse Faisalabad Property Rates

- See Quetta Property Rates

Invest with Confidence in RDA-Approved Housing Projects: Discover premium housing schemes in Rawalpindi that the RDA has approved for security and peace of mind.

Wrap up

Property DC Valuation ensures transparent, fair, and legal property transactions in Pakistan. By understanding DC rates, FBR rates, and e-Stamp calculations, you can avoid overpaying fees, plan taxes, and make informed property investments.

Discover the best places to invest by checking out the top 10 housing societies in Pakistan and finding your ideal community today.

FAQ (DC Valuation)

The DC value, also called the Deputy Collector (DC) rate or District Collector rate, is the official property value used by provincial governments to calculate stamp duty and capital value tax (CVT) on property transactions.

To calculate the DC value, follow these steps:

Identify the property location: Determine the Tehsil, district, city, town, and revenue circle where the property is located.

Consider property characteristics: Select the property type (residential, commercial, or agricultural) and the floor number if applicable.

Refer to provincial government rates: Check the current DC rates for rural or urban immovable properties provided by the provincial government.

Calculate the DC value: Multiply the property’s market value by the applicable DC rate. In most provinces, the rate is currently 3%.

The DC value is the legal benchmark for calculating stamp duty, CVT, and other property transfer fees. It ensures transparency, compliance, and fairness in all property transactions.

Comments are closed.

4 Comments

Dc rate kasy calculator karty hain

Here is the step-by-step process to get property DC Rate

Guide

what guidance do you require?